FHA isn’t the sole government-backed personal loan method. Two other packages — USDA loans and VA loans — give new residence loans without funds down.

What credit rating rating do you need for a Conventional ninety seven mortgage? A Conventional ninety seven loan demands a minimum amount credit score rating of 620. To transform your credit history, pay out your payments on time, shell out down bank card balances, dispute mistakes on the credit report, and limit your quantity of credit history inquiries.

Item name, symbol, brands, along with other emblems highlighted or referred to inside Credit Karma are classified as the house in their respective trademark holders. This site can be compensated via third party advertisers.

But don't truly feel like It's important to decide today. Your loan officer will assist you to Examine both equally options side by facet so you can see which 1 is truly very best to your circumstance. Examine your property personal loan options. Start here

Regular ninety seven demands that consumers make A 3 p.c deposit, which can originate from any suitable source. Eligible sources incorporate price savings, government down payment help applications, cash gifts from household or good friends, cash grants, and loans.

This regular 3% down choice is the greatest of many worlds: a very low deposit, cancelable mortgage loan insurance coverage, and a means to create a stronger present in aggressive housing markets.

Typical 97 just isn't much better or even worse than an FHA-backed home loan, but it check here may be a greater or even worse choice for your home finance loan needs.

Number of units: FHA mortgages permit loans for Attributes with as much as four dwelling units but you may obtain some Regular 97 loans are authorized for single-device residences only.

To qualify for obtain loans by having an LTV better than 95%, homeownership education and learning will probably be needed for a minimum of just one borrower, when all occupying borrowers are to start with-time homebuyers. Fannie Mae HomeView® can be utilized to satisfy this prerequisite.

Freddie Mac Dwelling One: Property A person also offers a three% down house loan financial loan with mortgage insurance policies essential. The Home One application has no money boundaries, but Should you be a primary-time homebuyer you’re required to take a homebuyer education class.

Find out more about our usage of cookies and pixels in our privateness coverage. I Realize Rate details within the charts and tables over comes from RateUpdate.com. The exhibited fees come from multiple providers and represent marketplace averages. Your home loan level will differ depending on specific elements like your credit rating score and also differing loan sorts and conditions provided by lenders. Get a customized quotation right here. Near Modal

The financial loan software can finance a single-spouse and children home or condo unit — assuming that the customer designs to use the house to be a Most important home.

Those with decrease credit score may well decide on FHA mainly because its mortgage loan insurance coverage is cheaper for all those with credit history scores below about 740.

Items from Family members: You may get a monetary gift from a relative to deal with your three% deposit and all closing costs.

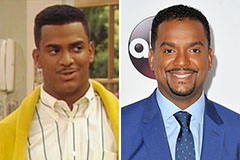

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now! Tyra Banks Then & Now!

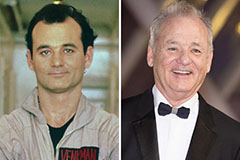

Tyra Banks Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!